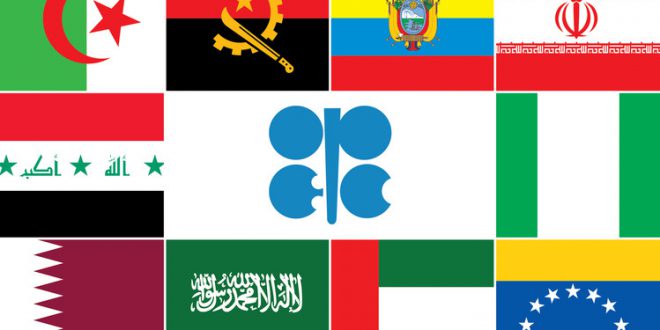

As crisis continues in Venezuela. net growth in total production capacity of the Organisation of Petroleum Exporting Countries would. among others. be determined by stability in Nigeria. Libya and Iraq. the International Energy Agency (IEA) has said.

IEA revealed this in its report. ‘Oil 2018: Analysis and Forecasts to 2023’. It noted that with Venezuela in crisis. net growth in total OPEC capacity would be only 750.000 barrels per day. This. the agency pointed out. would also be based on an assumption that shut-in production of around 500.000 b d from the neutral zone was finally re-started.

IEA said in the report. “Our analysis shows that discoveries of new oil resources fell to another record low in 2017. with less than four billion barrels of crude. condensate and NGLs found. In the past three years. we have seen oil production from China. Mexico and Venezuela fall by a combined 1.7 mb d as a consequence of lower investment. China’s decline has slowed. in Mexico. impressive reform proposals are being developed and production could return to growth by 2023.

“Meanwhile. Venezuela remains a wild card. In the twenty years since former President Chavez first came to power. oil production has more than halved to below 1.6 mb d. and capacity will plunge by nearly 700 kb d more by 2023. a major acceleration of the decline we expected a year ago. With Venezuela in crisis. the net growth in total OPEC production capacity will be only 750 kb d. and this number includes an assumption that shut-in production of around 500 kb d from the Neutral Zone is finally re-started. It also depends on some degree of stability in Iraq. Libya. and Nigeria.“

Venezuela has been enmeshed in protracted economic crisis precipitated by years of government mismanagement and exacerbated by a prolonged oil price slump. Following years of sharp output losses. Venezuela’s crude output is projected to tumble to 1.38 million barrels per day (mb d) by the end of 2018. according to the IEA. The level represents the country’s lowest level of output in approximately 70 years. except during the 2002-2003 general strike.

In another report of the IEA. the Oil Market Report for March. Venezuela was also fingered as the biggest risk factor

“Within the OPEC countries. the biggest risk factor is. and will likely remain. Venezuela. Our estimate for February shows output down again. by 60 kb d.“ the IEA said in the March OMR.

Back in Nigeria. there had been relative peace in the oil-rich Niger Delta. which has stabilised crude production around1.8 mb d. keeping to the OPEC Non-OPEC cut deal. But with condensates. the country produces about 2.2 mb d. The crude oil production target for 2018 is 2.3 mb d.

Nevertheless. Oil 2018 report projected that a strong world economy was expected to underpin solid increases in oil demand. According to the report. “The International Monetary Fund sees global economic growth at 3.9 per cent in the early part of our forecast period with all regions expected to perform well. Strong economies will. in turn. use more oil and we expect demand to grow at an average annual rate of 1.2 mb d. By 2023. oil demand will reach 104.7 mb d. up 6.9 mb d from 2017. As has been the case for some years. China and India together will contribute nearly 50 per cent of global oil demand. As China’s economy becomes more consumer-oriented. the rate of growth in oil demand slows down to 2023. compared with the 2010-17 period. In contrast. the pace of oil demand growth will pick up slightly in India. “

It noted that there was no peak oil demand in sight. saying the pace of growth will slow down to 1 mb d by 2023 after expanding by 1.4 mb d in 2018.

“There are signs of substitution of oil by other energy sources in various countries.“ the report stated. “A prime example is China. which has some of the world’s most stringent fuel efficiency and emissions regulations. As the country recognises the urgent need to tackle poor air quality in cities. efforts are intensifying. Sales of electric vehicles are rising and there is strong growth in the deployment of natural gas vehicles. particularly into fleets of trucks and buses. Our analysis shows that a rising number of electric buses and LNG-fueled trucks in China will significantly slow gasoil demand growth.“

However. IEA in the Oil 2018 envisaged that excess global refining capacity would grow. but Asian refiners need more crude.

The downstream sector. the report noted. would see major change during the forecast period. Excess global refining capacity is expected to increase due to the slowdown in refined product demand growth.

According to IEA. “Global refining capacity additions to 2023 are forecast to amount 7.7 mb d. At the same time. the rate of growth of refined product demand is slowing to 5 mb d. The growing excess refining capacity will eventually put pressure on margins. The Middle East sees the biggest growth in capacity and national companies in the region are venturing into international markets. targeting joint ventures. particularly in Asia. Even though Chinese capacity additions slow. the country maintains its recently acquired role as a net product exporter.

“With growing refining throughput. Asian import requirements grow by over 3.5 mb d. The Middle East countries will remain the largest suppliers. but their exports will only grow by 1 mb d. given their focus on domestic refining. Other sources such as Angola and Nigeria will have lower availabilities as. respectively. their output dwindles and they process more crude locally. This provides opportunities for new suppliers. mainly the US.“

Iran Energy News Oil, Gas, Petrochemical and Energy Field Specialized Channel

Iran Energy News Oil, Gas, Petrochemical and Energy Field Specialized Channel