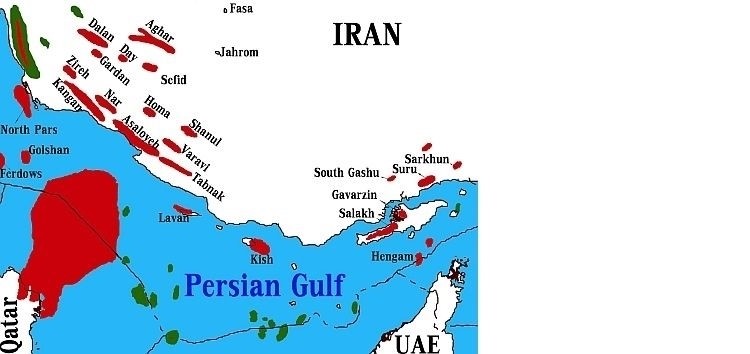

Iran will be a key focus area in 2017 as energy companies begin to sign contracts and explore offshore developments. Some of the largest offshore investments in the Middle East will be focused on Iranian projects. although there will also be plenty of expenditure in Saudi Arabia.

Royal Dutch Shell was the latest oil major to return to Iran in 2016. It signed agreements to consider developing the Kish gas field in the Persian Gulf and the Azadegan and Yadavaran onshore oil. It will be working with the National Iranian Oil Co (NIOC) on these projects if the existing memorandum of understanding turns into contracts.

Iran is focusing on increasing production of offshore gas by attracting foreign investment. Another of these offshore gas opportunities was gobbled up by Total and Chinese National Petroleum Co (CNPC). which recently reached a non-binding US$4.8 billion agreement to develop another section of the South Pars gas field. Together. they will be investing in offshore platforms. wells and pipelines in the South Pars 11 project in the coming years. Total will have a 50 per cent stake in this project. while NIOC subsidiary Petropars will have 20 per cent and CNPC will have 30 per cent.

In 2017. the project partners will negotiate a 20-year contract while Total will begin engineering studies and commence the tendering process so that construction contracts can be awarded immediately upon signature of the final agreement. Total expects the project will be developed in two phases. The first US$2 billion phase is expected to consist of 30 wells and two wellhead platforms connected to existing onshore treatment facilities by two subsea pipelines. A second investment phase could involve construction of offshore compression

Iran Energy News Oil, Gas, Petrochemical and Energy Field Specialized Channel

Iran Energy News Oil, Gas, Petrochemical and Energy Field Specialized Channel