The initial public offering of Saudi Arabia`s big oil company could be priced right in the middle of what could be a volatile period for oil.

Saudi Aramco intends to price its IPO on Dec. 5. the same day OPEC begins its regular two-day meeting in Vienna. The Aramco stock. equal to 0.5% of the company. is expected to trade on the Saudi Tadawul Exchange several days later. and market talk has focused on Saudi Arabia`s desire for higher and steadier prices.

Saudi Arabia Crown Prince Mohammed bin Salman has been looking for a $2 trillion value for Aramco. but bankers have said it is worth more like $1.5 trillion. Aramco said the company is worth $1.5 trillion at an oil price of $45. $1.76 trillion at $65. and $2.1 trillion at $75 per barrel. according to reports.

Analysts say there could be conflicts at OPEC`s meeting this year.. Saudi Arabia has been trying to rein in producers. such as Iraq and Nigeria. which are not complying with the production cuts OPEC agreed to with Russia and others. Some traders expect the agreed cuts of 1.2 million barrels a day to be increased. but Saudi Arabia is reportedly not in favor of changing the target until at least March. when the agreement runs out.

`Obviously. the biggest thing that`s going to decide where crude prices go in the next two or three weeks is going to be the OPEC meeting.` said Michael Bradley. energy analyst with Tudor. Pickering Holt. `My guess is the next two or three weeks we`re going to hear people staking out positions from a commodities standpoint.`

Bradley said some traders are looking for a potential new cut in production. though Reuters has quoted sources saying Saudi Arabia does not expect to change production targets. which expire in March.

`It looks like Russia is being a little bit antsy and not willing to move. and you have the Aramco IPO is pretty much intertwined with that meeting.` said Bradley. Underwriters are expected to run a book-building process between Nov. 17 and Dec. 4. during which time institutional investors will be expected to submit orders.

Brent crude. the international benchmark. has been trading mostly below $65 a barrel since June. Before that. it hit a high of just under $75 in April. Trade tensions between the U.S. and China have been a factor holding down prices. as have expectations for reduced demand growth and increased supply from the U.S. and elsewhere.

Oil prices have been lagging. as the U.S.. Brazil. Norway and Ghana increase production. while OPEC and its allies cut back. Bradley said OPEC members are overproducing by about 500.000 barrels a day. and non U.S. producers outside of OPEC could increase their output by between 400.000 and 600.000 barrels a day next year. U.S. producers could increase production by 700.000 barrels a day or more next year.

If there is a trade deal. demand growth could grow by 1.3 million or 1.4 million barrels a day next year. and that would help lift prices. Bradley said. Without it. demand could grow less than 1 million barrels per day.

In the meantime. OPEC plus. which includes Russia. has been trying to keep the price steady and higher. but trade tensions have been a wild card weighing on the price.

President Donald Trump and China President Xi Jinping are widely expected to come to terms on a first phase trade deal by mid-December. and there has been speculation that they could meet at the NATO meeting Dec. 3 and 4. If there`s a deal. that would be a powerful upside catalyst for oil. and OPEC could be less likely to quibble over production levels. If there`s no deal. a new wave of tariffs on Chinese goods are expected Dec. 15.

`It`s a high wire act.` said John Kilduff of Again Capital. `They run the risk at the same time of their meeting falling apart. and the oil price tanking. It`s a fraught history. To think this is shooting fish in a barrel is an absurd notion to me.`

Kilduff said while Iraq and Nigeria have been overproducing. Venezuela and Iran have been overcomplying. Both countries are being sanctioned by the U.S.

Oman`s energy minister said Monday that OPEC should extend its existing deal. but it is unlikely to deepen the cuts.

`They don`t want the price to collapse going into the meeting. but they don`t necessarily need it to go much higher.` said a source. familiar with OPEC`s thinking. The source said Saudi Arabia has a long term view that its oil company`s stock price could fluctuate with oil prices but that longer term. it`s going higher.

Bradley said Saudi probably wants a price above $65 per barrel for Brent going into the pricing. but longer term it would be fine at $60 to $65. Brent was at $62.19 per barrel in late trading Monday.

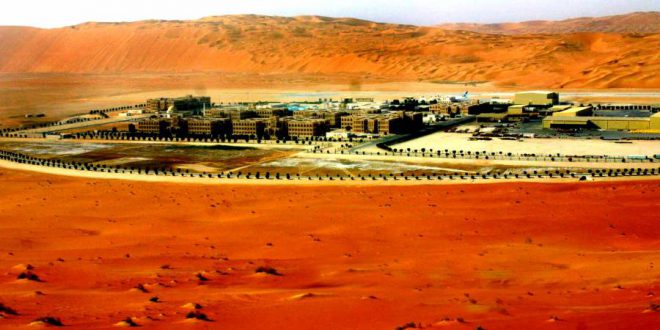

Besides oil price risk. Aramco highlighted other risks for investors in its report of a sharp drop in profits. related to the attack on its facilities in September. Aramco said its quarterly revenue declined in line with oil prices. but its profits fell to $21.2 billion from $30.3 billion due to purchases and other costs. Aramco resumed production within weeks of the attack on its Abqaiq and Khurais facilities but it had to buy imported oil for its refineries.

Iran Energy News Oil, Gas, Petrochemical and Energy Field Specialized Channel

Iran Energy News Oil, Gas, Petrochemical and Energy Field Specialized Channel