China, the world’s largest LNG importer, is set to keep the number-one spot this year and next and be an increasingly influential force on the global market as its natural gas storage is nearing capacity ahead of the winter.

China has spent years stockpiling gas, especially with high import volumes when prices were low, and has increased – by a government mandate – its domestic gas production.

China has ramped up its total gas imports so far this year and has built a high level of stockpiled gas as it looks to avoid a supply crunch when global markets tighten this winter.

They are set to tighten, especially if the winter in Europe and north Asia is cold. The end of the Russia-Ukraine gas transit deal on December 31, 2024, could trigger a run on LNG cargoes in Europe.

With a lot of gas in storage, China could once again turn to reselling LNG cargoes to Europe if Chinese importers and authorities feel the world’s second-largest economy is not threatened by a gas supply crunch.

Moreover, China is driving a hard bargain on future pipeline gas supply, especially from Russia.

Beijing is not committing to a massive new energy project to import Russian pipeline gas unless it’s favorable for the world’s second-largest economy.

Russia has been trying for years to get China to commit to a new natural gas pipeline from the massive fields in Western Russia to China via Mongolia. The proposed Power of Siberia 2 pipeline, despite Russian assurances, is nowhere near a concrete commitment from China on the price and volumes at which the Russian gas would be imported.

China is negotiating from a position of strength after becoming Russia’s key gas customer and key trade partner in all other areas following Putin’s invasion of Ukraine, which severed decades-long gas supply relations between Russia and Europe.

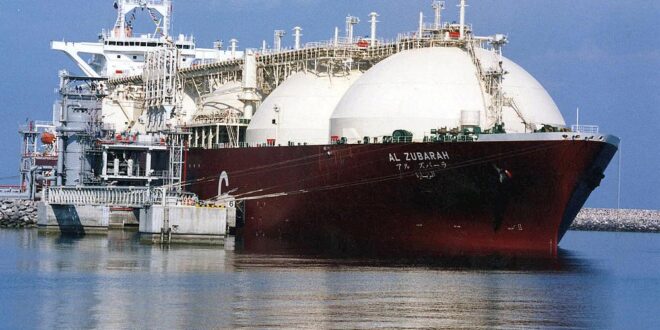

China’s increased gas imports and consumption in recent years have made it the world’s top LNG importer and the world’s second-largest LNG reseller.

Now, with inventories nearly full, China could be a force in the global LNG trade from a seller’s position, too.

In the longer term, however, China is set to decide whether to keep the pace of high gas inventories with growing imports or to reduce imports amid higher domestic production and soaring renewable energy capacity, Tim Daiss, energy markets analyst in the Asia-Pacific region, argues in an opinion piece in the South China Morning Post.

Natural gas could help China’s electricity sector reduce coal in its mix, and thus reduce carbon dioxide emissions, which authorities have pledged to peak by the end of the decade.

Still, China continues to approve coal-fired power capacity despite also being the world’s biggest investor and developer of renewable energy capacity.

China “made gains last year in efforts to restructure its natural gas market, increasing domestic production and consumption; boosting imports of liquefied natural gas; adopting technologies to boost domestic exploration and production and cut emissions; and reforming pipeline transmission tariffs,” Shangyou Nie and Erica Downs wrote in a report last week for the Center on Global Energy Policy at Columbia University.

Currently, China provides about 60% of its gas demand with domestic supplies, thanks in part to reforms aimed at increasing domestic supplies and consumption, they estimate.

“As the world takes on many challenges from climate change and energy transition, China’s use and views of natural gas in its energy mix are critically important,” Nie and Downs wrote.

As the largest carbon emitter globally, China needs to aim for at least a 30% CO2 emissions reduction by 2035 in its new climate targets if the world has a chance to meet the Paris Agreement goals, Finland-based think tank Centre for Research on Energy and Clean Air (CREA) said in a report last week.

Although natural gas is still a fossil fuel, its increased use at the expense of coal could help lower part of the emissions in the power sector and provide baseload capacity to balance grids with more solar and wind energy.

Iran Energy News Oil, Gas, Petrochemical and Energy Field Specialized Channel

Iran Energy News Oil, Gas, Petrochemical and Energy Field Specialized Channel