Oil prices edged higher on Tuesday as China unexpectedly cut key policy rates for the second time in three months to shore up a sputtering economic recovery, although sluggish economic out of Beijing put a lid on gains.

Brent crude futures rose 32 cents, or 0.4 per cent, to trade at $86.53 per barrel by 0644 GMT. U.S. West Texas Intermediate crude was up 26 cents, or 0.3 per cent, to $82.77 a barrel.

Prices turned higher after the People’s Bank of China (PBOC) lowered the rate on 401 billion yuan ($55.3 billion) in one-year medium-term lending facility (MLF) loans to some financial institutions by 15 basis points to 2.5 per cent.

The cash injection was to counteract factors including tax payments in order to “keep banking system liquidity reasonably ample”, the PBOC said in an online statement.

“The market was expecting the PBOC to wait until September before easing again, and today’s cuts suggest that the authorities’ concern about the state of the macroeconomy is mounting,” said Robert Carnell, Asia Pacific head of research for ING Bank, in a note.

China’s industrial output and retail sales data on Tuesday showed the economy slowed further last month, intensifying pressure on already faltering growth and prompting authorities to cut key policy rates to shore up activity.

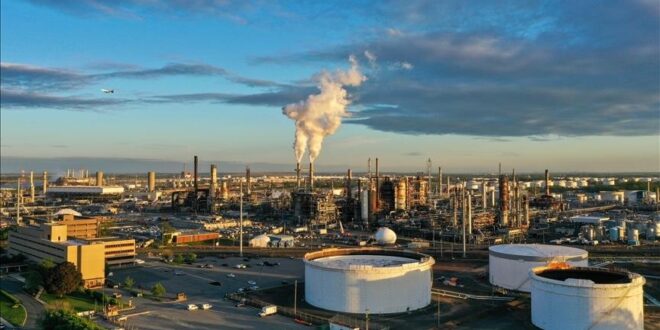

Despite the weak macroeconomic data, China’s oil appetite showed resilience. The country’s refinery throughput in July rose 17.4 per cent from a year earlier, as refiners kept output elevated to meet demand for domestic summer travel and to cash in on high regional profit margins by exporting fuel.

Also lending support to oil prices, Japan’s economy grew much faster than expected in April to June, as brisk auto exports and tourist arrivals helped offset the drag from a slowing post-COVID consumer recovery.

Meanwhile, oil and natural gas output from top U.S. shale-producing regions is set to fall in September for the second straight month to the lowest levels since May, Energy Information Administration data showed on Monday.

The declining U.S. output could exacerbate global oil supply tightness as the Organization of the Petroleum Exporting Countries and its allies, known as OPEC+, cut production.

Iran Energy News Oil, Gas, Petrochemical and Energy Field Specialized Channel

Iran Energy News Oil, Gas, Petrochemical and Energy Field Specialized Channel