Refiners face an existential crisis as the growing divergence between refining capacity and demand for refined products will intensify sharply in the next two decades, the International Energy Agency said Oct. 13.

More than 6 million b/d of new capacity will come online from now to 2025, but demand will only grow by 2 million b/d during this period, the IEA said in its World Energy Outlook 2020.

This forecast comes as the Paris-based agency expects the era of global oil demand growth will come to an end in the next decade,

“But without a large shift in government policies, there is no sign of a rapid decline,” said IEA Executive Director Fatih Birol. “Based on today’s policy settings, a global economic rebound would soon push oil demand back to pre-crisis levels.”

Refinery throughput will grow at only half the pace seen in the last decade, as refineries are “further challenged by a structural shift in oil use away from transport fuels and towards petrochemical feedstock,” the report said.

This change in the type of oil demand, means that refineries will have to adapt, with some diversifying into petrochemical and low-carbon businesses to survive, while others will have to close.

While in Europe and the West refinery plants will be converted into bio-refineries as a way of securing new sources of revenue as well as reducing end-use emissions.

The sector will have to move away from its traditional focus on converting crude oil into various oil products as the period of fuel-centric growth is “slowly drawing to a close.”

“It is likely to morph over time into a sector that will convert a wider range of materials [including biomass and plastic waste] into products valued by consumers,” the IEA added.

The year 2020 was supposed to the year of better margins for refiners but the coronavirus pandemic arrived abruptly forcing it to confront some deep structural problems.

Analysts were estimating diesel demand to spike buoyed by the advent of the International Maritime Organization’s sulfur cap.

Refining margins and utilization rates plunged to the lowest levels in 35 years, as the pandemic thwarted oil demand, disproportionately affecting the most lucrative products such as gasoline, diesel and jet fuel, the report noted.

Asia to dominate

Traditional refiners, mostly in advanced economies, will continue to lose market share to their peers in Asia and the Middle East.

These two regions will strengthen their presence in the global refining industry.

“By 2030, some 14% of today’s refining capacity in advanced economies faces the risk of lower utilisation or closure,” according to the IEA.

Asia and the Middle East account for two-thirds of global refining investment over the past five years, and for more than 80% of refining capacity currently under construction.

Despite a growing appetite for oil, the investment case for new refineries in Central and South America and Africa have weakened considerably, as they would face fierce competition from existing refiners seeking export outlets.

“Market share for refiners is squeezed even further by the fact that an increasing share of oil products (mostly those used as petrochemical feedstock) bypasses the refining system altogether, primarily because they are sourced from NGLs,” the report said.

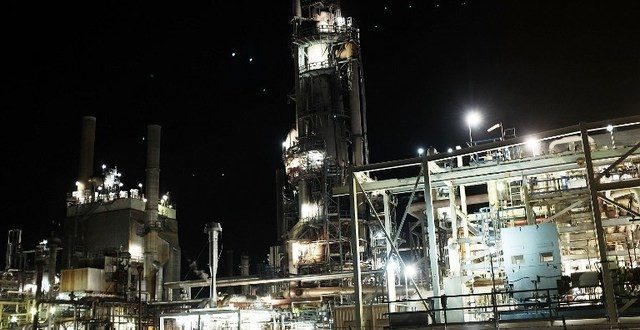

BIG SPRING, TX - JANUARY 19: An oil refinery is lit up in the night on January 19, 2016 in Big Spring, Texas. Global oil prices continue their downward fall with U.S. oil dropping towards $27 a barrel, its lowest since 2003, on worries about global oversupply. Following a diplomatic agreement on nuclear fuel with America, Iran has forecast it will add 500,000 barrels per day to global production, following the lifting of sanctions. Spencer Platt/Getty Images/AFP

Iran Energy News Oil, Gas, Petrochemical and Energy Field Specialized Channel

Iran Energy News Oil, Gas, Petrochemical and Energy Field Specialized Channel