President Trump has spent significant political capital during the coronavirus pandemic tending to the wounds of shale oil producers, but refiners who transform the crude into fuels for consumers are suffering as well.

Refineries, with no demand for their fuel, are already operating at about 30% lower capacity than what they usually do, and some have shut down operations completely.

“U.S. refiners, especially the independents, are also facing the same economic crunch as the shale guys, and we could also see some bankruptcies,” said Joe McMonigle, a former Energy Department chief of staff in the George W. Bush administration.

Trump could make things harder for the refiners if he fulfills the wishes of some oil-state Republican senators and blocks a deluge of incoming tankers from Saudi Arabia set to deliver oil to U.S. refiners over the next four weeks.

Republicans such as Kevin Cramer of North Dakota, Ted Cruz of Texas, and Lisa Murkowski of Alaska say the extra Saudi crude would worsen an already historic glut and price crash.

“The tankers filled with Saudi crude will only worsen U.S. oversupply and storage issues, and Senator Murkowski is hopeful they will be routed to a different destination,” Grace Jang, a spokeswoman for Murkowski, told the Washington Examiner.

The refining industry, however, has a strong presence in swing states such as Pennsylvania and Ohio, whereas the shale industry is dominant in red states.

“It would seem to be more politically perilous to ignore the refining issues,” McMonigle said. “Consumers and politicians seem to be extremely sensitive when pump prices rise. Imagine if some refiner bankruptcies result in gasoline shortages or the country needs to start importing gasoline and products. The political backlash has potential to be big.”

The refinery industry in Pennsylvania was already wounded last year when the state’s largest and oldest refinery, the Philadelphia Energy Solutions Refining Complex, permanently shut down after a massive fire.

Trump won Pennsylvania, where refineries operate in mostly the rural western part of the state, by fewer than 45,000 votes in 2016.

With such a small margin, “there certainly is some political risk for the president if he is alienating this part of the energy sector with a policy like this,” said Christopher Borick, a political science professor at Muhlenberg College in Pennsylvania.

The problem for U.S. refiners is that many were built to run medium-and-heavy crude of the type that Saudi Arabia makes, and can’t only rely on shale producers that specialize in light, sweet oil.

Lobbying groups for refiners oppose a blockade of Saudi oil coming into the United States because it would disrupt the global energy market, narrow their options for imports, and raise their prices, which would be passed to customers.

“Crude oil is not really valuable except if it can be run through a refinery and turned into products every day. Our concern is if you did a restriction, be it with tariffs or up to an embargo, that would make our refining much less competitive worldwide. It would be a whole lot of pain for not a lot of gain,” said Derrick Morgan, senior vice president of federal and regulatory affairs for American Fuel & Petrochemicals Manufacturers, the top U.S. refining lobby.

Only 3% of the oil used by U.S. refineries last year came from Saudi Arabia, a portion trending downward over recent years as domestic shale became dominant.

But some refineries are especially dependent on Saudi Arabian crude, especially those on the West Coast that are forced to import because of a lack of pipeline capacity to transport U.S. oil.

If Trump were to block the oil or interfere with agreed-to contracts, he’d risk upsetting the relationship between U.S. refiners and Saudi Arabia, while giving up business to other countries that would absorb the crude planned for the U.S.

“We will need foreign sources of oil for the foreseeable future, and we need to make sure we are not destroying those relationships when it’s not going to help, and the real problem is the demand problem,” Morgan said.

Morgan’s group, along with the larger American Petroleum Institute, representing U.S. oil producers and refiners, are encouraging Trump to focus on helping states restart their economies.

Refineries are able to more quickly ramp up and down their activity compared to shale producers and would be primed to pick up their pace once people start driving and flying again.

But that would be more difficult if Trump restricted refiners’ supply options by blocking Saudi oil.

“Our guys want to be ready to hit on all cylinders when the economy is back and want to have ready supply when that happens,” Morgan said. “We are asking the government to not make things worse and let the market sort it out. Don’t make the cure worse than the disease.”

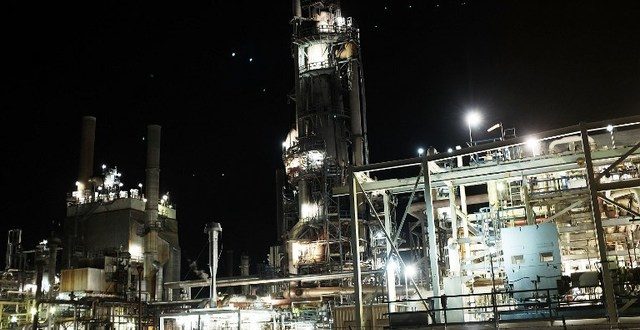

BIG SPRING, TX - JANUARY 19: An oil refinery is lit up in the night on January 19, 2016 in Big Spring, Texas. Global oil prices continue their downward fall with U.S. oil dropping towards $27 a barrel, its lowest since 2003, on worries about global oversupply. Following a diplomatic agreement on nuclear fuel with America, Iran has forecast it will add 500,000 barrels per day to global production, following the lifting of sanctions. Spencer Platt/Getty Images/AFP

Iran Energy News Oil, Gas, Petrochemical and Energy Field Specialized Channel

Iran Energy News Oil, Gas, Petrochemical and Energy Field Specialized Channel